When SAP Feels Like Overkill: AI-Native Alternatives for Mid-Market

According to a 2025 Godlan analysis of ERP implementation data, 73% of discrete manufacturing ERP projects failed to meet their objectives, with average cost overruns reaching 215%. SAP implementations skew toward the more complex end of that spectrum—longer timelines, higher consulting costs, and deeper customization requirements. For mid-market distributors who implemented SAP and found themselves managing more system than they need, the math is worth revisiting.

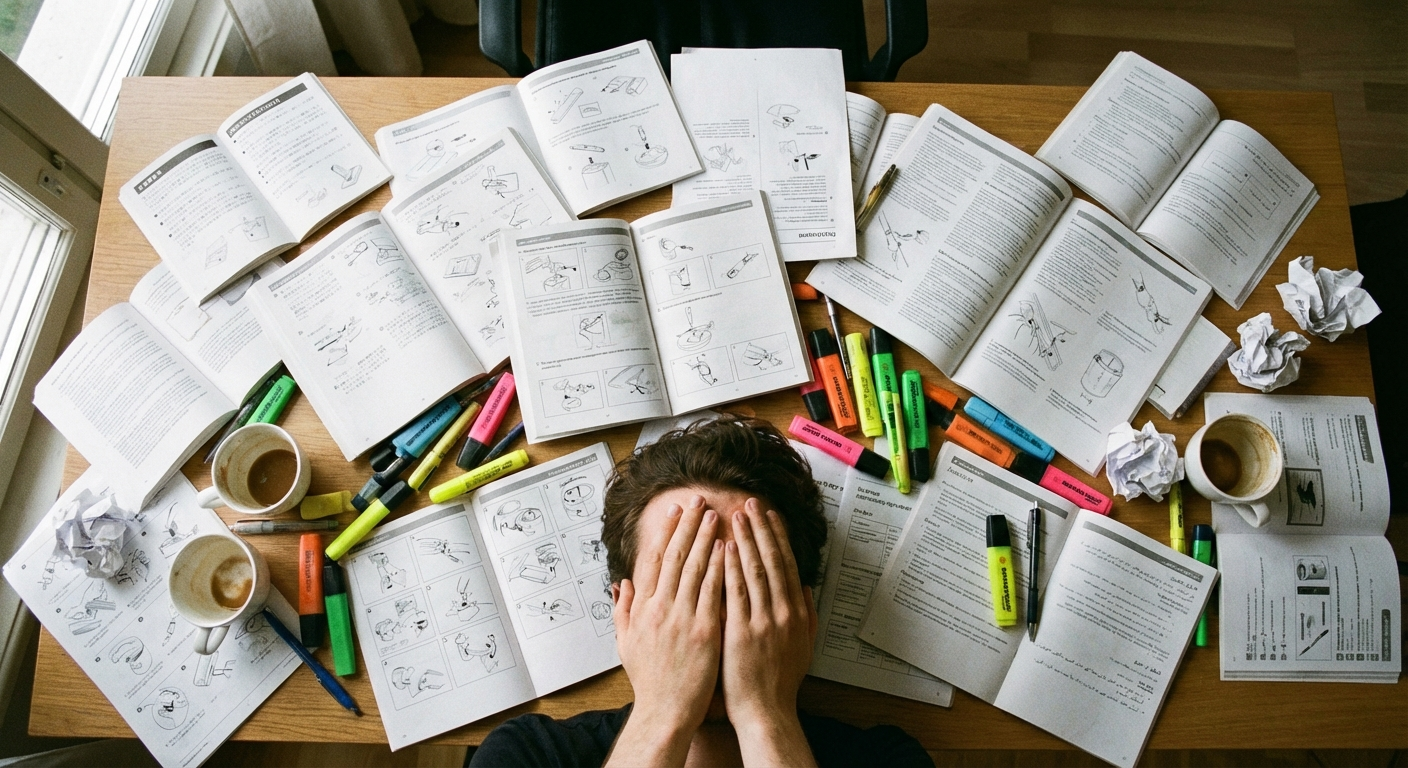

SAP is exceptional software for companies with the scale and complexity to leverage it fully. But mid-market distributors—$20M to $500M in revenue, 50 to 500 employees—often land in a painful middle ground: too big for entry-level systems, not big enough to justify SAP's overhead. The implementation took longer than planned. Customizations cost more than the software. Half the features go unused. Every change request becomes a consulting engagement.

If that description resonates, there are alternatives worth examining.

The Complexity Tax

The costs of running SAP at the mid-market extend beyond the license fee. They compound across every aspect of operations.

Implementation burden. Even "quick" SAP Business One implementations typically run four to six months. Larger SAP S/4HANA projects routinely take 18 to 24 months before reaching production value. According to Clarkston Consulting's 2025 SAP Trends report, SAP continues to push customers toward cloud migration through RISE and GROW offerings—but the migration itself represents another multi-month project on top of existing system management.

Customization costs. SAP's power comes from configurability. But that configurability requires specialists billing $200 to $400 per hour. A "simple" customization easily runs $20,000 to $50,000. Complex ones cost multiples of that. Many mid-market SAP customers spend more on customization over the system's lifetime than they spent on the initial license.

Upgrade friction. Every customization creates upgrade risk. Companies get trapped on old versions because upgrading threatens custom code—and eventually run unsupported software with accumulating security and compliance exposure. SAP's ECC to S/4HANA migration pressure makes this particularly acute right now.

Integration as a project. SAP integrates with everything, in theory. In practice, every integration is a scoped project. CRM connection? Project. E-commerce platform? Another project. Third-party logistics system? Same pattern. Each one requires SAP-specific expertise that commands premium rates.

Gartner's 2025 IT spending forecast projects business software spending growing 14.7% in 2026 to $1.4 trillion. But that growth is increasingly flowing toward AI-native platforms and cloud services rather than traditional on-premise ERP implementations—a reallocation that reflects shifting buyer priorities.

The AI-Native Alternative

A new generation of platforms are being built AI-first rather than adding AI to existing architectures. The difference is architectural, not cosmetic.

Natural language instead of screen navigation. Traditional software requires clicking menus, filling forms, and navigating workflows designed for trained power users. AI-native platforms accept natural language—spoken or typed. "Show me inventory for electrical fittings across all warehouses" replaces a multi-screen lookup process. The complexity is still handled; it's just hidden from the user.

Adaptive instead of configured. Traditional ERP requires extensive upfront configuration to match business processes—a primary driver of implementation timelines and costs. AI-native systems learn from data and adapt. They observe patterns, suggest optimizations, and handle edge cases intelligently rather than requiring pre-programmed rules for every scenario.

Connected by default. AI-native platforms assume integration. They're built with APIs from the ground up and treat connecting to other systems as configuration rather than development. Real-time data flow is standard, not premium.

Mobile and voice first. Instead of desktop software with mobile afterthoughts, AI-native platforms are designed for the devices and interfaces people actually use. Voice interaction isn't an add-on—it's a primary interface. According to industry data, 70% of businesses already use mobile CRM systems, and those that do see measurable productivity gains.

"McKinsey's research found that AI early movers in distribution stand to increase cash flow by 122%, while late adopters risk losing up to 23%. The question for mid-market distributors running overweight ERP isn't just about reducing complexity—it's about competitive positioning."

The Hybrid Path

Full ERP replacement carries its own risks—the same 73% failure rate applies. For companies not ready to migrate entirely, a middle option exists: keep SAP as the system of record and add an AI layer that transforms the user experience.

This approach preserves the SAP investment and data, adds modern voice and mobile interfaces without SAP customization, delivers AI-powered insights on existing data, and avoids migration risk. The accounting team might still use SAP directly for complex transactions. Field sales interacts through conversational interfaces. Everyone works with the same underlying data.

It's also a low-risk way to evaluate whether the full SAP footprint is justified. If an AI layer handles 80% of daily interactions, the remaining 20% may not justify the ongoing complexity and cost of the full SAP installation.

Should You Replace Your ERP — or Enhance It?

73% of ERP replacements fail to meet objectives. Get a data-driven recommendation in 5 minutes — no sales pitch.

Take the ERP AssessmentEvaluation Criteria

Whether exploring full replacement or augmentation, several factors separate serious alternatives from marketing promises.

Distribution-specific capability. Complex pricing, multi-warehouse inventory, branch operations, rebates, and commissions need to work natively—not through customization. Generic ERP with distribution bolted on repeats the same pattern that makes SAP feel overweight.

Implementation timeline. Modern platforms should deploy in weeks. If a vendor quotes six-plus months for basic functionality, that's a signal of architectural complexity that will compound over time.

Total cost of ownership. License cost is the least important number. Implementation, customization, integration, training, and ongoing support costs determine actual TCO. SAP's premium is less about the software fee and more about the ecosystem cost to operate it.

User experience quality. Evaluate with real users—especially field users. Good tools attract better salespeople. According to AnswerIQ's research, 78% of companies without mobile CRM failed to reach their sales quotas. The UX quality of distribution tools has direct revenue impact.

Vendor trajectory. Distribution is a long game. Is the vendor growing, investing in the product, and likely to exist in ten years? AI-native doesn't help if the company building it runs out of funding in three.

When to Stay, When to Move

Consider staying with SAP if: dedicated SAP expertise is on staff, the implementation is stable and well-adopted, advanced capabilities justify the complexity, or the company's growth trajectory will fill out SAP's capacity over time.

Consider alternatives if: the team fights the system more than uses it, simple changes require consulting engagements, user adoption remains a problem years after implementation, capabilities go unused, or the IT budget is disproportionately consumed by SAP maintenance.

Consider an AI layer if: SAP works for back-office but fails for field operations, modern capabilities are needed faster than SAP's roadmap delivers, migration risk is too high but the current experience is unacceptable, or the organization wants to test modern approaches without full commitment.

Making the Call

The question isn't whether SAP is good software—it is. The question is whether mid-market distributors are getting sufficient return on the complexity they're managing. When every process change requires a consultant, when half the features go unused, when field teams work around the system instead of through it—the overhead may exceed the value.

Both augmentation and transition can deliver modern capabilities without the multi-year projects and ongoing consulting bills that characterize traditional ERP approaches. The right path depends on the current SAP investment, the team's capacity for change, and how central SAP is to daily operations.

For companies where SAP feels like wearing steel-toed boots to an office—technically protective but impractical for actual work—it's worth exploring what's changed in the market since that implementation decision was made.