Hidden Costs of the Multi-Vendor Tech Stack

According to MuleSoft's 2025 Connectivity Benchmark Report, based on interviews with 1,050 IT leaders globally, disconnected systems remain the top barrier to digital transformation. Only 58% of IT leaders have adopted API-led integration strategies, and the number of AI models deployed in enterprises was expected to double from 2024 to 2025—each requiring its own data connections. Meanwhile, a Gartner survey found that marketing professionals alone reported overall tech stack cost as the top concern for 61% of respondents, with 32% admitting they don't use the full capabilities of their current tools.

The pitch for best-of-breed is compelling: pick the best CRM, the best ERP, the best inventory tool, the best route optimizer. Each vendor is a specialist. But a distribution business isn't a collection of isolated functions. Customer data affects inventory decisions, which affect route planning, which affects sales strategy, which affects customer service. When tools are siloed, maintaining those connections becomes an ever-growing tax on the business.

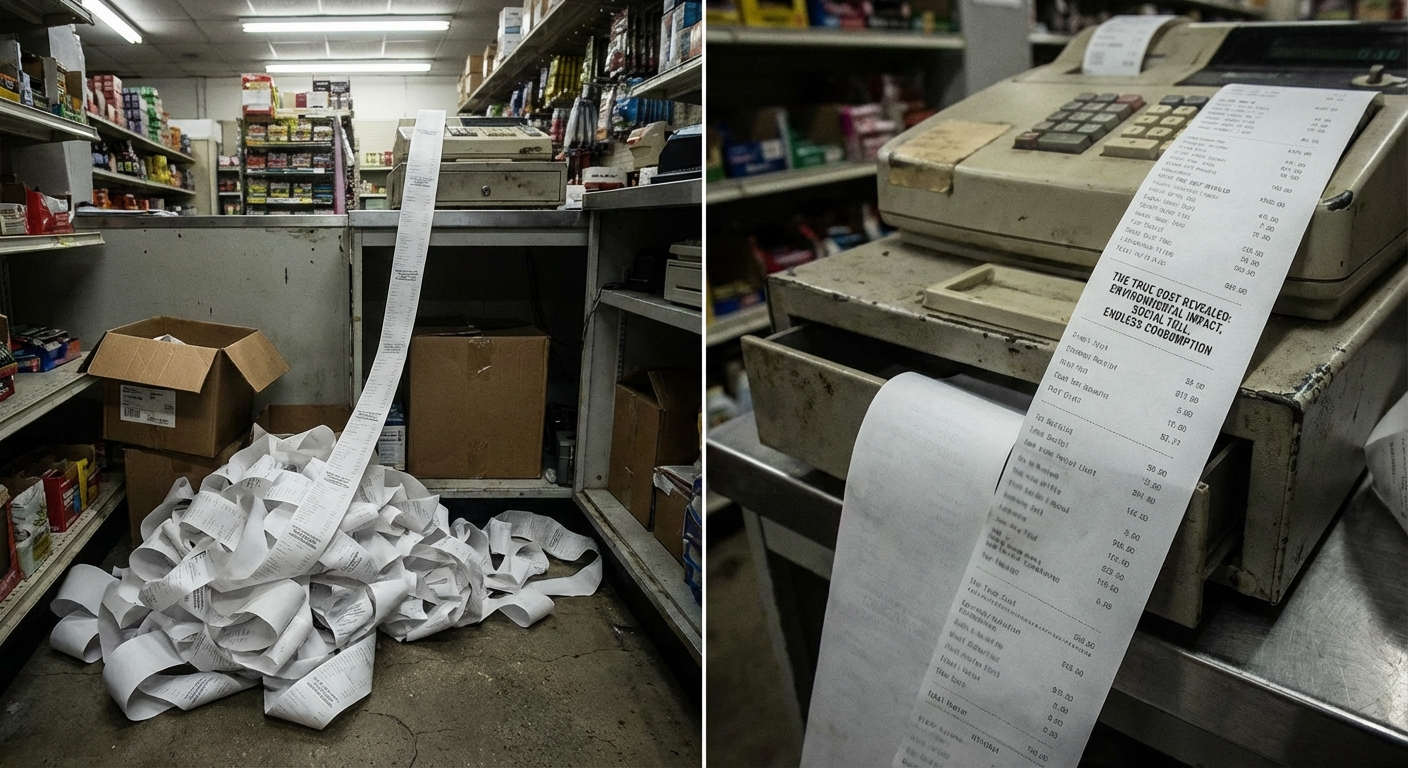

The Vendor Management Tax

Every vendor relationship requires management, and the overhead multiplies fast. Each vendor has its own contract structure with different renewal dates, pricing models, and terms. Miss a renewal date and the auto-renewal locks in unfavorable terms. Forget to negotiate before renewal and leverage disappears.

Support fragmentation is where the real pain lives. When something breaks across system boundaries, the response is predictable: "That's not our issue—talk to the other vendor." Each vendor has no incentive to solve problems that cross system boundaries. The customer—the distribution company—plays translator in the middle, often spending days resolving issues that a single-vendor system would fix in hours.

Then there's the relationship overhead. Each vendor wants quarterly business reviews. Each has a customer success manager who needs face time. Roadmap discussions, feedback sessions, contract negotiations—with eight vendors, the team spends more time managing technology relationships than running distribution operations.

of IT leaders have adopted API-led integration strategies—meaning 42% are still connecting systems through brittle, manual, or ad-hoc methods.

Source: MuleSoft, 2025 Connectivity Benchmark Report

The Integration Tax

Multi-vendor stacks only work if the pieces connect, and that connection has ongoing costs that are easy to underestimate.

Initial integration: Each integration is a $10,000 to $100,000 project depending on complexity. A typical mid-market distributor needs 15–20 integrations to connect the stack. At the low end, that's $150,000 in integration projects before the systems even work together.

Maintenance: Budget 15–20% of initial integration cost annually for upkeep. APIs change, vendors update their systems, data formats evolve. That $150,000 in integrations now costs $25,000–$30,000 per year to maintain—indefinitely.

Middleware platforms: Many companies use tools like MuleSoft, Boomi, or Workato to manage integrations. These carry their own licensing costs—often $25,000 to $100,000+ annually depending on volume and complexity. Gartner projects global IT spending will exceed $6 trillion in 2026, and integration is one of the fastest-growing line items.

Staff capacity: Someone needs to own integrations. That's headcount devoted to plumbing instead of value creation—either dedicated specialists or existing team members pulled away from business problems to troubleshoot data sync failures.

How Much Revenue Are You Leaving on the Table?

Free 5-minute assessment reveals where your distribution business is silently leaking 5-15% of potential revenue.

Take the Free AssessmentThe Data Consistency Tax

When data lives in multiple systems, consistency becomes a perpetual challenge with real operational consequences.

Most integrations aren't real-time. Between syncs, systems show different information for the same entity. A customer updates their address in the CRM; for the next hour, the ERP shows the old address. An order ships to the wrong location. When systems disagree on a customer's credit limit—one number in CRM, another in ERP, another in accounting—someone has to investigate and reconcile. Multiplied across thousands of records, that's significant ongoing labor.

Audit and compliance compound the problem. When regulators or auditors request records, assembling information from multiple sources is expensive and risky. Every integration point is a potential gap where data could be lost or inconsistent.

The Security Tax

Each vendor represents an attack surface. When an employee leaves, access needs to be revoked across every system—with one platform, that's one action; with eight vendors, it's eight chances to miss something. Each vendor has its own security practices; the organization's security posture is only as strong as the weakest vendor. And the probability of at least one vendor experiencing a breach increases with every vendor added to the stack.

The Innovation Tax

This may be the most significant hidden cost. Multi-vendor stacks slow down the ability to change. Adding a new capability means first figuring out how it integrates with everything else. A new AI feature requires checking whether the data architecture can support it. A process improvement means coordinating across three vendors' roadmaps.

Companies with unified platforms move faster. They deploy new features without integration projects. They experiment without coordination overhead. Over time, that speed advantage compounds into competitive differentiation that's difficult to reverse.

New to Voice AI? Start Here

Our getting-started guide covers the basics without the jargon.

Read the GuideThe Platform Alternative

A unified platform eliminates most of these costs by design: one vendor to manage, one contract, one support number. No integrations between core functions because they're the same system. Data consistency is automatic because there's a single data store. Security surface is contained. Innovation is faster because there's one roadmap, no coordination required.

The standard objection: "But the unified platform isn't best-of-breed at everything." That's fair. The counterpoint: the integration costs of best-of-breed often exceed the capability gap. A platform that's 90% as good at each function but works seamlessly together routinely outperforms a collection of best-of-breed tools that fight each other.

Doing the Math

For distribution companies running multi-vendor stacks, an honest accounting of total cost is the necessary first step. Add up visible costs: every license, every support contract, every integration platform fee. Then estimate the hidden costs: staff time on integration maintenance, data sync problems, support finger-pointing, security overhead, and the innovation friction of coordinating across vendors.

Compare that total to what a unified platform costs for the same functional coverage. The gap—often $200,000 to $400,000 annually for a mid-market distributor—tends to surprise people who've only been looking at license fees.

Stay Ahead of the Curve

Get weekly insights on AI, distribution, and supply chain delivered to your inbox.