The Field Sales Tech Stack That Actually Gets Used in Distribution

Seventy percent of businesses now use mobile CRM systems, according to SLT Creative's 2025 CRM market research — and those businesses report a 14.6% productivity improvement. Yet distribution field sales teams consistently underperform on technology adoption. The reason is not resistance to technology. It is that most field sales technology was designed for someone sitting at a desk.

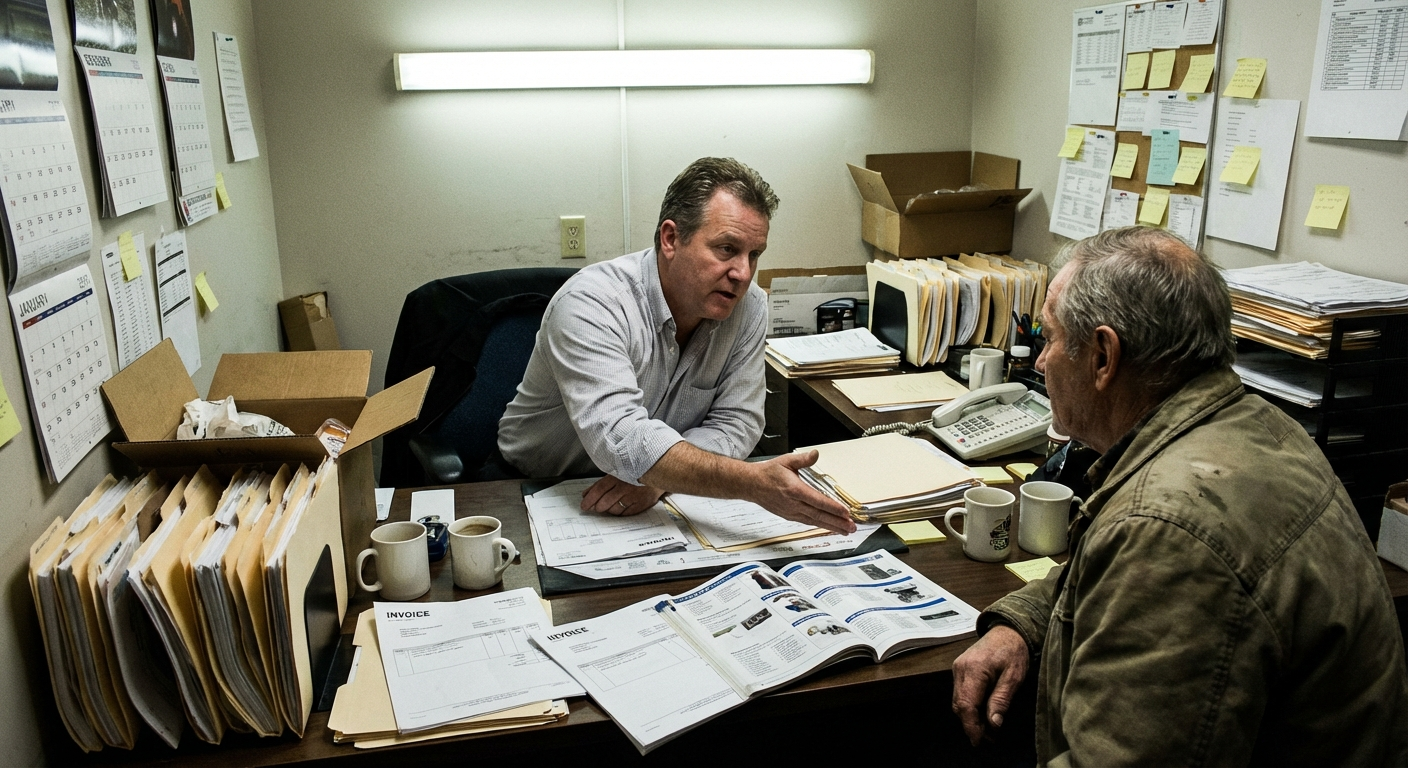

Distribution field reps make five to eight customer stops per day. They work in warehouses with poor connectivity, on job sites with no Wi-Fi, and in truck cabs where typing on a phone screen is impractical or dangerous. The tech stack that works for an inside sales team is fundamentally wrong for field operations.

Why Adoption Fails

The adoption problem is well-documented. According to Tech.co's 2025 CRM report, manual data entry is the single biggest barrier to CRM adoption, with 32% of reps spending more than an hour daily on it. In field distribution sales, that burden is amplified: reps are entering data in hostile environments — glare, noise, gloves, one-handed operation — using tools optimized for mouse and keyboard.

91% of companies with 10+ employees now use CRM — but adoption rates tell only half the story

— SellersCommerce, 2025 CRM Statistics. Adoption without actual usage means incomplete data and wasted licenses.

The failure pattern is consistent across distribution: a company invests in a CRM or field sales platform, deploys it to the team, and watches usage decay over weeks as reps revert to paper, memory, and phone calls to the branch. The tool technically works. It just does not work for people who spend their days moving.

What a Field-First Stack Requires

The technology stack that actually gets used in distribution field sales shares a set of non-negotiable characteristics, regardless of which specific products fill the slots:

Mobile-native design. Not a responsive desktop app — a tool built phone-first. Fast loading on cellular connections. Large touch targets for work-gloved hands. Interface flows designed for one-handed operation. The test: can a rep complete a customer visit record in under sixty seconds?

Offline capability. Distribution reps routinely enter buildings with no signal — cold storage facilities, below-grade loading docks, rural customer sites. Any tool that requires constant connectivity will have data gaps precisely where they matter most. Offline-first with background sync is a hard requirement.

Integrated order entry. Orders are the job. The field platform must connect to the ERP's pricing engine and inventory system in real time. If a rep has to tell a customer "let me check when I get back to the office," the tool has failed its primary purpose.

Voice input. Typing on a phone screen while walking a warehouse floor or sitting in a truck produces slow, error-prone data. Voice note capture, voice search, and increasingly voice-based order entry are shifting from nice-to-have to essential. According to the 2025 Voice AI Reality Check from Speechmatics, enterprise speech recognition now handles noise, accents, and domain-specific vocabulary at production-grade accuracy.

Minimal data entry. Every field that requires manual input is a field that may not get filled. Smart defaults, auto-population from ERP data, previous-order templates, and "same as last time" shortcuts reduce the entry burden to what actually requires human judgment.

The Core Components

A complete distribution field sales stack covers six functional areas. The best implementations unify them in a single interface rather than forcing reps to switch between apps:

CRM with customer intelligence. Full account history at a glance before walking in: recent orders, open quotes, service tickets, payment status, key contacts. Alerts for significant changes — a long-time customer whose order volume dropped, or a new account that is ramping. According to CRM.org, 65% of businesses have already adopted CRM systems with generative AI, which can surface these patterns automatically.

Order entry with live pricing and inventory. Product search that handles natural language and partial identifiers. Customer-specific pricing applied automatically. Real-time inventory visibility across branches. The ability to build, modify, and submit orders entirely from the field.

Route and schedule management. Territory visualization, optimized routing, and one-tap navigation. When a customer cancels or an urgent stop gets added, the system should re-optimize the remaining route without requiring the rep to rebuild their day.

Communication tools. Integrated calling with automatic logging, text messaging (many B2B customers prefer it), email templates, and internal messaging to branch support. The goal is a single communication hub rather than scattered threads across personal phones and email.

Content and pricing access. Product specifications, technical data sheets, images, and availability — accessible offline. Customer-specific pricing that the rep can show on-screen during conversations. Competitive comparison data for selling situations.

Analytics and coaching. Activity tracking that helps managers identify where reps are winning and where they need support. Territory performance data. Pipeline visibility. These serve the organization more than the individual rep, but they are essential for field sales management.

How Much Revenue Are You Leaving on the Table?

A 5-minute assessment that identifies where your distribution business may be leaking revenue.

Take the Free AssessmentWhat to Avoid

The mistakes that kill field sales technology investments follow predictable patterns:

Feature-bloated enterprise platforms. Reps will use 10% of the features and suffer 100% of the complexity. Simplicity in the field interface is a feature, not a limitation.

Multiple disconnected point solutions. Switching between apps kills productivity. A rep who needs one app for orders, another for CRM, a third for route planning, and a fourth for product specs will eventually consolidate to the only tool that is always available: their memory.

Desktop-first tools with mobile afterthoughts. If the mobile experience feels like a shrunken desktop screen, adoption will not survive the first month.

Solutions requiring desktop sync. Any workflow that requires plugging a phone into a computer at the end of the day creates a bottleneck where data goes to die.

Measuring Whether It Is Working

The metrics that reveal whether a field sales tech stack is delivering value are:

Field completion rate. What percentage of orders are entered in the field versus batched at the end of the day? Higher field completion means faster order processing and fewer errors from delayed entry.

Visit record completeness. Are customer interaction notes being captured? A system that reps bypass produces no data and no value.

Time to order confirmation. How long from a customer's request to a confirmed order? This is the most customer-visible metric and should decrease measurably with good tooling.

Rep satisfaction scores. Ask the field team directly: does this make your job easier? The answer correlates strongly with sustained adoption.

Businesses using CRM see an average ROI of $8.71 for every dollar spent

— SellersCommerce, 2025 CRM Industry Report. But only when the system is actually adopted by the field team.

New to Voice AI? Start Here

A getting-started guide that covers the basics without jargon.

Read the GuideThe Technology That Is Coming

Two emerging capabilities are worth watching for distribution field sales specifically:

Voice-first interfaces are moving from novelty to primary input method. As enterprise speech recognition improves — Speechmatics reports production-grade accuracy across 55-plus languages in noisy environments — voice is becoming viable for order entry, not just note-taking. Distributors piloting voice-based field workflows report that reps who adopt it rarely go back.

AI-powered recommendations are becoming practical rather than aspirational. With 65% of businesses already running CRM systems with generative AI, according to CRM.org and Kixie, the infrastructure for pattern detection is in place: identifying upsell opportunities from order history, flagging at-risk accounts from declining purchase frequency, and suggesting products based on what similar customers buy.

The unifying thread is reducing friction. Every second of load time, every unnecessary field, every extra tap between a rep and the information they need costs adoption. The field sales tech stack that wins is the one that disappears into the work — fast enough, simple enough, and capable enough that using it is easier than not using it.

Stay Ahead of the Curve

Get weekly insights on AI, distribution, and supply chain delivered to your inbox.